Consolidate Your Debt and Start Saving Today

Use a Debt Consolidation Mortgage to Simplify Your Payments and Reduce Interest

Is Debt Consolidation Right for You?

Debt consolidation might be the right solution if you’re a homeowner with equity and are dealing with high-interest debts.

By leveraging your home equity, you can pay off those high-interest balances and consolidate them into a single, manageable monthly payment.

This approach could help you save thousands on interest and simplify your finances, giving you greater control and peace of mind.

Understanding the Difference Between Good Debt and Bad Debt

Distinguishing Smart Investments from Costly Liabilities

Good Debt

Secured Against Valuable Assets

Good debt is typically tied to assets that appreciate in value, such as your home.

Common Examples

- Mortgage:

Borrowing to purchase a home. - Home Equity Line of Credit (HELOC):

Accessing the equity in your property for various financial needs.

Advantages

- Lower Interest Rates:

Often much lower than unsecured loans, especially in favorable market conditions. - Asset-Backed Loans:

Reduce lender risk, leading to more favorable terms for borrowers.

Bad Debt

Unsecured Debt

Bad debt is not tied to any specific asset and often comes with higher risks and costs.

Common Examples

- Credit Card Balances:

High-interest rates on unpaid balances can quickly grow out of control. - Personal Lines of Credit:

Loans without collateral, leading to higher costs and limited repayment options.

Challenges

- High Interest Rates:

Bad debt often comes with significantly higher interest, making repayment more expensive. - Managing Debt:

Multiple unsecured debts can become overwhelming and difficult to manage effectively.

Strategies to Manage Bad Debt

1. Consolidation

Combine multiple debts into a single loan with a lower interest rate, simplifying payments and reducing financial stress.

2. Refinancing

Replace existing debt with a new loan offering better terms to lower monthly payments and reduce the overall financial burden.

Key Takeaway:

Good debt helps build wealth by leveraging valuable assets, while bad debt creates financial strain due to high interest and unsecured liabilities.

Managing bad debt through strategies like consolidation and refinancing can significantly improve your financial stability.

Summary

- ✔Good Debt: Includes mortgages and HELOCs tied to valuable assets with lower interest rates and favorable terms.

- ✔ Bad Debt: Involves credit card balances or personal lines of credit with high interest rates and no collateral.

- ✔Key Difference: Good debt builds wealth, while bad debt can strain financial resources.

- ✔Debt Strategies: Consolidation and refinancing simplify payments, reduce interest costs, and improve financial stability.

How to Consolidate Through My Debt Consolidation Services

Simplify Your Finances with One Easy Payment

What is Debt Consolidation?

- Definition:

- Debt consolidation involves taking out a single loan to pay off multiple existing debts.

- Visualization:

- Imagine your debts as separate boxes. Debt consolidation combines them into one larger, organized box, making it easier to manage.

Benefits of Debt Consolidation

- Simplified Monthly Payments:

- Consolidate multiple payments into one loan payment each month.

- Potential Interest Rate Reduction:

- Reduce overall interest rates to save money over time.

- Improved Financial Control:

- Minimize the complexity of managing multiple debts and regain control of your finances.

How It Works

- Assessment:

- I analyze your current debts and financial situation to identify the best consolidation strategy.

- Loan Application:

- Apply for a consolidation loan with favorable terms tailored to your needs.

- Debt Payoff:

- Use the loan to pay off all existing debts, eliminating multiple payments.

- Single Payment:

- Manage one manageable monthly payment toward your consolidation loan, streamlining financial management.

Why Choose My Services?

- Personalized Guidance:

- Step-by-step support through the entire consolidation process.

- Tailored Solutions:

- Customized plans aligned with your unique financial needs.

- Top Lender Connections:

- Access to lenders offering competitive rates and terms.

- Stress-Free Process:

- Clear communication and efficient solutions to help you achieve financial stability.

Summary

- ✔Simplify Finances: Debt consolidation combines multiple debts into one manageable payment.

- ✔Save Money: Reduce overall interest costs and free up resources.

- ✔Guided Support: I’ll assist you every step of the way toward a secure and stress-free financial journey.

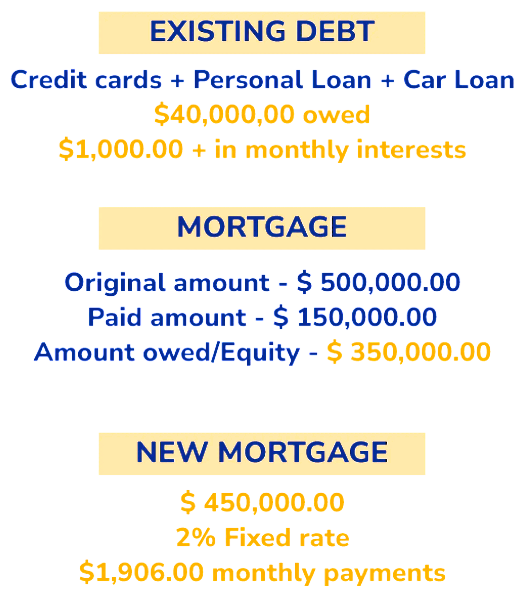

Debt Consolidation Example:

How It Works

Mike’s Financial Situation Before Consolidation

- Total Debt: $40,000

- Types of Debt:

- Personal loan

- Credit cards

- Car loan

- Types of Debt:

- Monthly Interest:

Over $1,000 - Impact:

- Struggled to reduce the principal balance effectively due to high-interest payments.

Mike’s Home Equity Details

- Home Purchase:

- Original Purchase Price:

$500,000 (purchased five years ago) - Current Property Value:

$700,000

- Original Purchase Price:

- Mortgage Information:

- Original Mortgage:

30-year fixed-rate - Initial Down Payment:

20% - Current Mortgage Balance:

$350,000

- Original Mortgage:

- Available Equity:

- Total Equity Available:

$350,000

- Total Equity Available:

Debt Consolidation Strategy

- Refinancing Approach:

- New Mortgage Amount:

$450,000 (covers existing debts and closing costs) - Fixed Interest Rate:

2.0%

- New Mortgage Amount:

- Monthly Payment:

- New manageable monthly payment: $1,906

Benefits of Mike’s Debt Consolidation

- Debt Elimination:

- Paid off personal loan, credit cards, and car loan.

- Interest Savings:

- Before Consolidation:

Over half of the monthly payment went toward interest. - After Consolidation:

Reduced interest payments significantly with a 2.0% fixed rate.

- Before Consolidation:

- Financial Management:

- Simplified into one manageable mortgage payment instead of multiple debt payments.

- Improved Cash Flow:

- A larger portion of the monthly payment now reduces the principal balance.

Key Takeaways from Mike’s Debt Consolidation

- Utilizing Home Equity:

- Leveraged home equity to fund debt consolidation and close high-interest debts.

- Lower Interest Rates:

- Reduced overall interest burden, saving money and accelerating debt repayment.

- Simplified Finances:

- Combined multiple debts into a single, easy-to-manage payment.

- Increased Financial Stability:

- Reduced stress by managing debt effectively and improving cash flow.

Summary

- ✔Debt Consolidation: Mike used $40,000 of home equity to refinance high-interest debts.

- ✔ Lower Interest Rate: Reduced his rate to 2.0%, saving on interest costs.

- ✔Simplified Payments: Consolidated multiple payments into one, reducing monthly payments to $1,906.

- ✔Financial Stability: Improved cash flow and accelerated debt repayment for a more secure financial future.

How I Support You Every Step of the Way

Personalized Guidance for a Stress-Free Experience

1. Comprehensive Assessment

- Conduct a detailed evaluation of your unique financial situation.

- Take the necessary time to fully understand your needs and challenges.

2. Tailored Debt Consolidation Plan

- Develop a customized plan based on your financial assessment.

- Ensure the plan is aligned with your specific goals and requirements.

3. Connecting with Top Lenders

- Match you with the best-suited lenders for your circumstances.

- Negotiate competitive rates to secure the best possible loan terms.

4. Dedicated Solutions

- Commit to finding the perfect solution tailored to your needs.

- Emphasize that every financial situation has a suitable resolution.

Summary

- ✔Personalized Support: Receive step-by-step guidance for a stress-free debt consolidation process.

- ✔ Thorough Assessment: I evaluate your financial situation to create tailored solutions.

- ✔Top Lender Access: Connect with leading lenders to secure the best options.

- ✔Competitive Rates: I negotiate favorable terms to help you save.

- ✔Peace of Mind: My mission is to help you achieve financial stability and regain control efficiently.